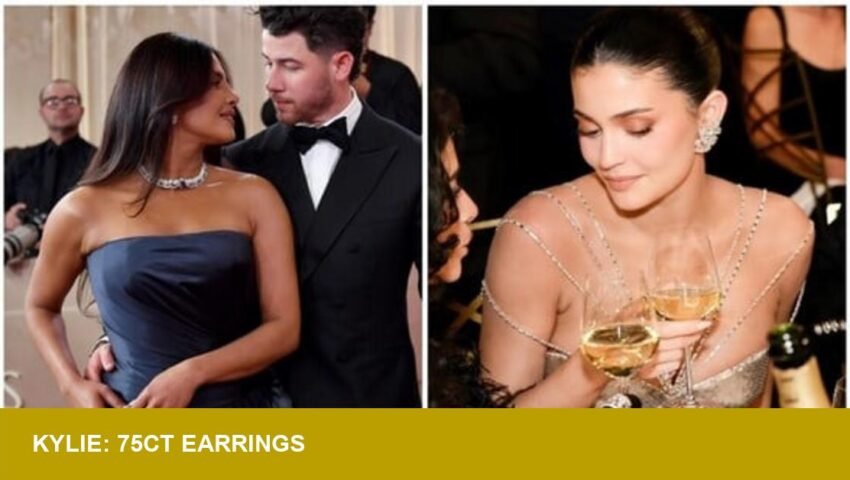

Second Headline: At the 2026 Golden Globes, Priyanka Chopra wore a diamond‑sapphire necklace with visible substantial heft and vitreous luster while Kylie Jenner showed 75 carats of sapphire in earrings — dealer and auction-house estimates place both pieces squarely in collectible, multi‑million territory.

- Priyanka Chopra — Diamond‑Sapphire Necklace: Estimated value: $600,000–$2,000,000; Carat weight: not disclosed; Origin: not disclosed; Date: Jan 2026, Golden Globes.

- Kylie Jenner — 75‑ct Sapphire Earrings: Estimated value: $3,000,000–$8,000,000; Carat weight: 75 ct (total reported); Origin: not disclosed; Date: Jan 2026, Golden Globes.

- Jennifer Lawrence — Accent Piece: Estimated value: $50,000–$300,000; Carat weight: varied small stones; Origin: not disclosed; Date: Jan 2026, Golden Globes.

Context: What the Red Carpet Revealed about 2025–26 Trends

The red carpet at this year’s Globes underscored three persistent market currents. First, demand for large, saturated colored stones — sapphires in this case — continues to drive attention and price discovery in secondary markets. Second, the traceability conversation that dominated 2025 remained active: buyers and brokers now prize documentation and provenance as much as cut and color. Third, sculptural, weighty settings that show a piece’s substantial heft are influencing retail display and valuation models.

Why This Matters to Retailers and Investors

For U.S. retailers, these appearances translate into immediate merchandising and risk-management considerations. High‑net‑worth clients responding to celebrity visibility will seek stones with verifiable origin and lab reports; that shifts inventory toward certified natural stones and away from unvetted lots. The tactile appeal — the vitreous luster and palpable heft of large sapphires — is selling not just as jewelry but as collectible objects. Retailers should ensure appraisals, insurance and consignment pathways are in place before displaying comparable stock.

For investors, the takeaways are surgical. Large, saturated natural sapphires retain a premium against mass‑market lab‑grown alternatives, particularly at sizes that attract headline attention. Auction results tied to celebrity provenance can create short‑term spikes; long‑term appreciation still depends on documentation, gemological grading and market liquidity. Monitor major auction houses, lab reports (GIA, AGL) and post‑sale analytics rather than relying on social‑media impressions alone.

Practical Steps and Risks

- Prioritize pieces with complete paperwork: origin reports, treatment disclosures, and up‑to‑date appraisals.

- Reassess insurance limits for display events; celebrity sighting can increase loss/theft risk and claim values.

- Consider consignment relationships with auction houses for one‑off, high‑value colored stones to test resale appetite.

- Be cautious about headline-driven valuation: immediate dealer estimates may widen into wider auction ranges.

What to Watch Next

Follow auction catalogs and post‑sale reports for any stones linked to these appearances; numbers published there will establish the market benchmarks retailers and investors need. As the year progresses, expect traceability and sculptural design to remain decisive factors in pricing and salability.

Observed on the carpet: pieces that combine technical grading, visible substance and verified provenance command not just attention but measurable market value. For practitioners in the U.S. jewelry trade, that is a signal to align inventory, certification and sales channels with a quietly discerning buyer base.

Image Referance: https://www.msn.com/en-in/entertainment/bollywood/priyanka-chopra-s-diamond-sapphire-necklace-kylie-jenner-s-huge-75-carat-earrings-best-jewellery-at-golden-globes-2026/ar-AA1U1GU7?cvid=696abd8e43624aec8cd7c6c1ff659f4b&apiversion=v2&domshim=1&noservercache=1&noservertelemetry=1&batchservertelemetry=1&renderwebcomponents=1&wcseo=1