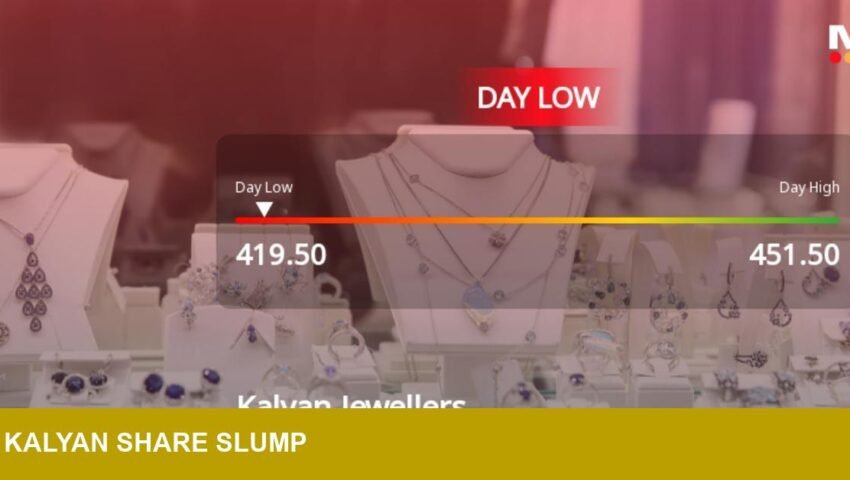

Kalyan Jewellers India Ltd recorded a pronounced intraday decline on 21 Jan 2026, falling to a low of Rs 428.45 as the stock came under sustained selling pressure. The move underlines near‑term price vulnerability for the listed jeweller and a potential reappraisal by investors of demand visibility in the sector.

- Intraday low: Rs 428.45

- Date: 21 January 2026

- Company: Kalyan Jewellers India Ltd

- Market: Indian equities (domestic jewellery retail)

- Driver: sustained selling pressure on the stock

Context: jewellery retail and market positioning in 2025–26

The share weakness for Kalyan Jewellers arrives amid a broader environment where listed jewellery retailers face shorter inventory cycles and heightened sensitivity to discretionary consumer spending. For market participants, the immediate price action reflects investor concern about near‑term revenue visibility rather than a single product or design shift. Publicly traded jewellers are particularly exposed to changes in footfall, marriage season timing and working‑capital cycles; the stock reaction suggests those variables are being priced in by the market.

Impact: what this means for investors and trade

Traders and institutional investors with exposure to Indian retail should treat the intraday low as a liquidity and sentiment signal. For wholesalers and retailers, falling listed valuations can tighten access to capital and prompt conservative inventory replenishment. Merchants may accelerate assortment strategies that prioritise lower carat‑weight, higher‑turn items — such as delicate micro‑pavé pieces or satin‑finished gold designs — to protect margins and cash flow. For overseas investors tracking India, the move is a reminder to reassess position sizing against company‑specific visibility and sector‑wide demand indicators.

While the intraday figure does not by itself indicate structural weakness, it increases the importance of near‑term indicators: store sales trends, disclosure on gross margins and working‑capital disclosures in the next quarterly filings. Market participants should monitor those metrics before assuming the sell‑off reflects a durable shift in consumer demand.

Image Referance: https://www.marketsmojo.com/news/stocks-in-action/kalyan-jewellers-india-ltd-hits-intraday-low-amid-price-pressure-3797955