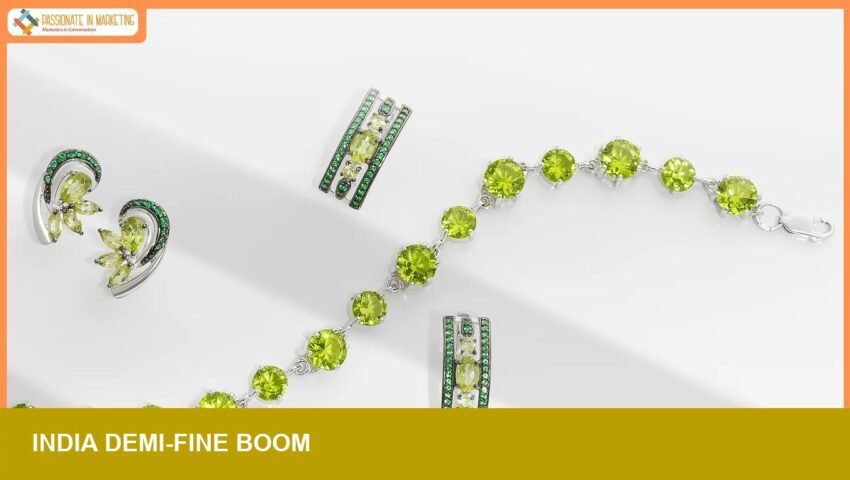

Gen Z consumers are accelerating a visible shift in India’s jewellery market: demand is moving from traditional gold-as-investment toward demi-fine pieces that prioritise accessible price points, ethical sourcing and Instagram-led design. The change is already prompting retailers and manufacturers to reweight assortments and could, if sustained, moderate demand for investment-grade gold while creating new margin pools for design-led demi-fine labels and importers.

- Category: demi-fine jewellery (India)

- Primary drivers: Gen Z, social media/Instagram

- Design priorities: affordability, ethical sourcing, trend-led aesthetics

- Market implication: shift away from gold-for-investment towards wearable design

Context: how demi-fine fits 2025–26 trends

The pivot toward demi-fine in India reflects broader industry currents for 2025–26: younger buyers favour design and provenance over intrinsic metal value, and they discover products through short‑form social content rather than family heirloom pathways. This cohort prefers lighter-weight silhouettes, refined surface finishes and layerable proportions that photograph well on feeds — attributes that reduce per‑unit metal content and accelerate inventory turn.

Ethical claims and traceability are central to the proposition. In practice that means retailers emphasise recycled metal sourcing, clear supply stories and vetted makers rather than relying solely on karat‑value messages. For design houses and wholesalers, demi-fine’s appeal is its ability to combine controlled cost bases with higher perceived design value — a classic margin play when executed with disciplined quality control.

Impact: why US retailers, wholesalers and investors should watch

Although this shift originates in India, it has several implications for the US market. First, US retailers targeting Gen Z and younger millennials should expect demand for lower‑ticket, design‑forward jewellery that carries strong provenance claims. That opens opportunities for private‑label demi-fine assortments, faster product cycles and experiments in social‑first merchandising.

Second, importers and wholesalers will need new sourcing strategies: suppliers in India that can deliver repeatable, design‑led collections at accessible price points will be more valuable than those solely focused on bullion fabrication. For investors, the trend signals category rotation risk for pure‑metal inventory models and a potential reallocation of working capital toward designs and marketing rather than metal stock.

Finally, merchandising and marketing must adapt. Quiet‑luxury cues — restrained proportions, satin and polished finishes, and meticulous joinery — combined with transparent ethical messaging, perform well on social channels and create a defensible retail proposition without competing on gold value alone. For dealers and brands, the practical response is to segment assortments by purchase motive (investment vs design), pilot demi‑fine capsules, and sharpen supply‑chain traceability to meet Gen Z expectations.

Image Referance: https://www.passionateinmarketing.com/from-heirlooms-to-hashtags-is-consumer-behaviour-shift-towards-affordable-luxury-jewellery-driving-indias-demi-fine-boom/