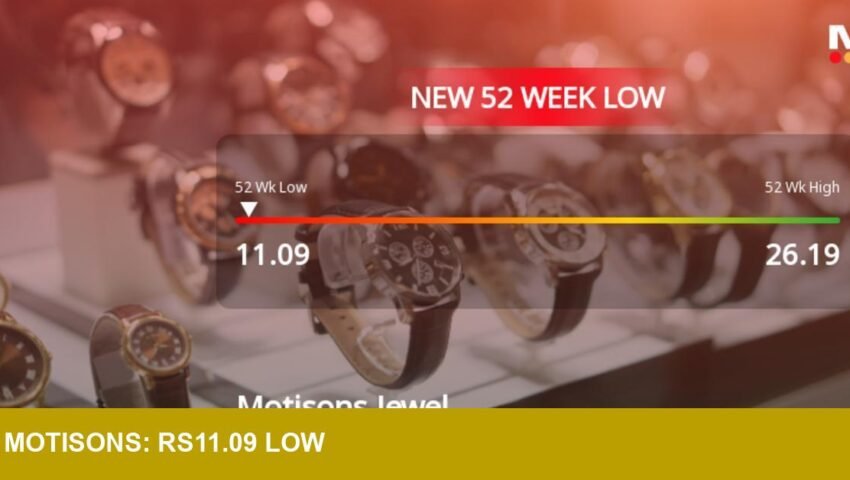

Motisons Jewellers Ltd has touched a fresh 52‑week low of Rs.11.09 today, marking a notable milestone in an ongoing price decline for the listed jewellery retailer and reflecting continued investor pressure on the stock.

- Share price: Rs.11.09 (fresh 52‑week low)

- Event: Recorded today; part of a prolonged downtrend

- Company: Motisons Jewellers Ltd (listed jewellery retailer)

- Market region: India equities; relevant to specialist jewellery investors

Context: sector pressures and where this fits in 2025–26

The move sits within a wider framing of jewellery retail vulnerability: operating models are capital‑intensive (inventory of finished goods and bullion exposure), margins are sensitive to gold and polished‑stone cost swings, and consumer discretionary spend remains uneven. For specialist listed players such as Motisons, sustained price declines often mirror a combination of weak sell‑through, heightened working‑capital needs and investor rotation away from smaller cap retail names.

For merchandisers and product teams, the commercial lesson is structural rather than aesthetic: assortments with lower working‑capital churn (for example, streamlined chains and classic 18k satin‑finished gold pieces that turn more quickly) typically fare better through demand troughs than heavily bespoke high‑cost inventory.

Impact: why US retailers, wholesalers and investors should pay attention

While Motisons is an India‑listed company, the stock’s fall has pragmatic implications for US market participants who source from or invest in the global jewellery supply chain. Wholesalers and buyers importing from India should monitor supplier credit risk and delivery cadence; a prolonged decline in a supplier’s market valuation can presage tighter payment terms or production slowdowns.

For investors, the drop highlights two portfolio considerations: exposure to small‑cap jewellery retailers can amplify volatility in an environment of commodity swings and discretionary softness; and sector rotation toward larger, better‑capitalised players or categories with steadier sell‑through may accelerate if listed mid‑cap names remain under pressure.

Corporate updates, exchange filings and trade receivables disclosures will be the next credible datapoints to watch. Market participants should treat today’s Rs.11.09 print as a risk signal that warrants active monitoring rather than immediate judgement.

Image Referance: https://www.marketsmojo.com/news/stocks-in-action/motisons-jewellers-ltd-stock-hits-52-week-low-amidst-prolonged-downtrend-3800622