Gold’s Ascent: Fed Rate Speculation Fuels Unprecedented 2025 Market Rally

Gold is signaling a significant weekly gain, firmly positioning it for a historic rally projected for 2025 as institutional investors adjust their portfolios in response to anticipated Federal Reserve rate cuts. Futures maintained a position above $2,420 per ounce, reflecting a market sentiment that is increasingly treating the metal as a primary hedge against currency devaluation. This momentum, while slightly moderated from recent record highs, establishes a new floor, creating substantial cost pressures for the entire fine jewelry supply chain.

- Current Price: ~$2,420/oz

- Weekly Gain: ~1.2%

- 2025 Forecast: Goldman Sachs projects a $2,700/oz target by Q2 2025

- Primary Driver: Over 90% market consensus on a 25-basis-point Fed rate cut

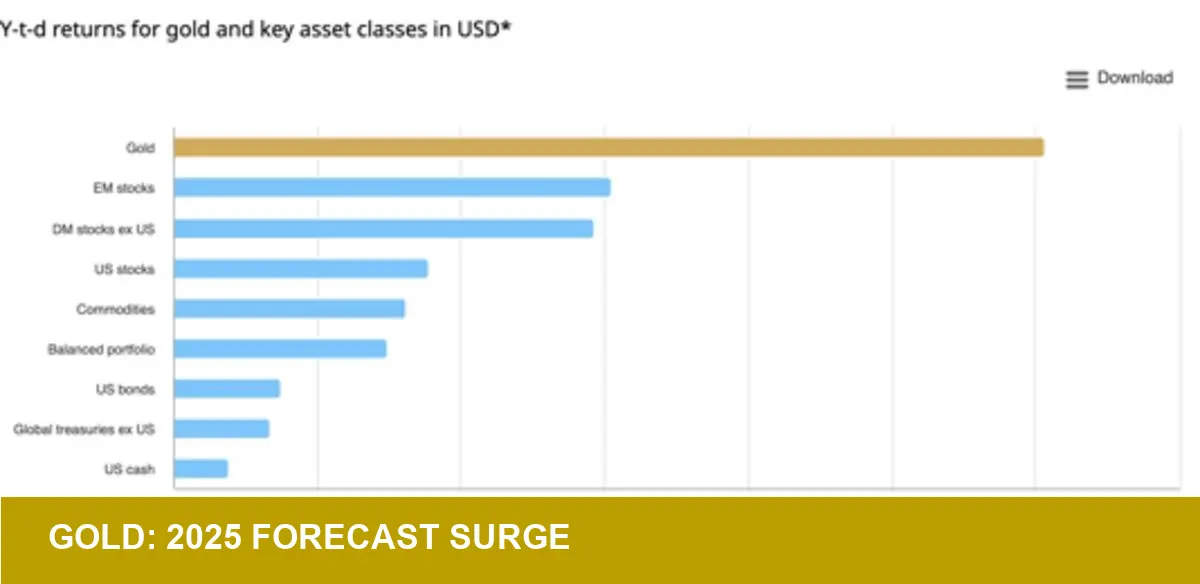

The New Economic Context: Asset Reallocation

The current market dynamics are a direct reaction to macroeconomic indicators. With inflation persisting above targets, investors are preemptively moving capital from equities into hard assets. This is not a fleeting trend but a foundational shift in asset allocation strategy. The market is pricing in the Fed’s future actions, making gold’s performance less about current demand and more about its role as a forward-looking economic barometer. This recalibration is closely tied to the 2025 outlook for lab-grown diamond value, as retailers and investors alike seek stable stores of value in a volatile landscape.

Impact on US Retailers and Investors

For US jewelry retailers, this rally is a critical warning. The sustained increase in gold’s base cost will exert a direct and unavoidable pressure on wholesale pricing for everything from bridal settings to fine fashion pieces. Retailers must now strategically evaluate their inventory holding costs and revise 2025 pricing models to protect margins without alienating consumers. For investors, the takeaway is clear: the factors driving this rally are deeply embedded in monetary policy, suggesting a long-term bullish outlook for the metal’s intrinsic value.

Image Referance: https://www.msn.com/en-us/money/markets/gold-on-pace-for-weekly-win-as-momentum-drives-historic-2025-rally/ar-AA1RNDSq?ocid=finance-verthp-feeds