The Second Headline: A Low-Tech Breach Exposes High-Value Risk

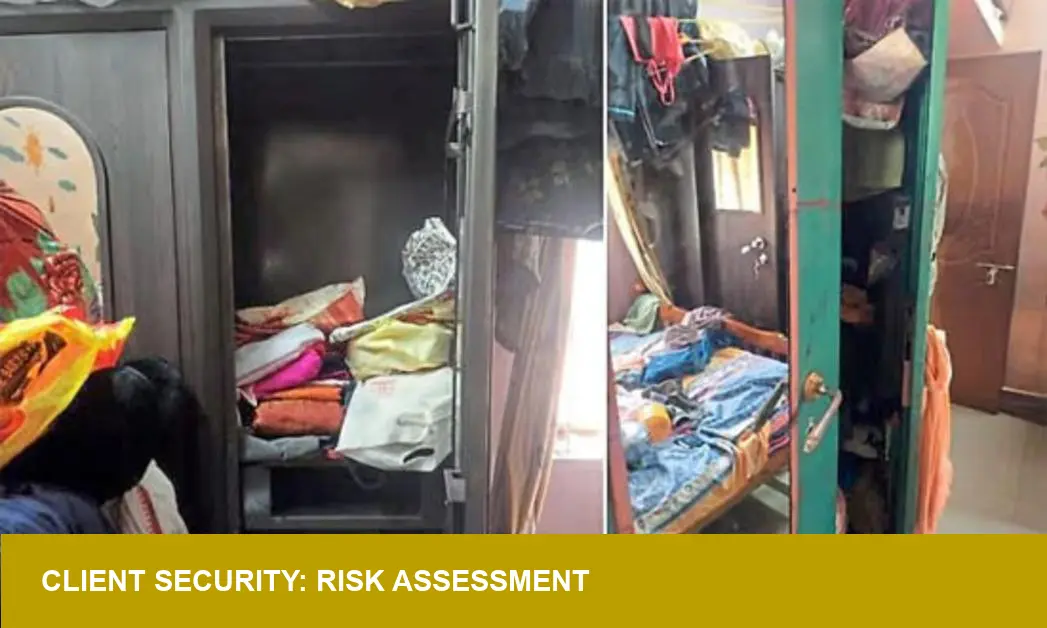

A provincial burglary in Kaup, India, where thieves stole approximately $4,700 in gold using a spare key, has inadvertently exposed a critical vulnerability for US jewelers. While the absolute value is negligible, the method reveals a systemic weakness in client home security—a risk that directly impacts retailers who manage and service high-value private collections. The incident underscores a pressing need for enhanced advisory protocols beyond the showroom floor.

- Incident Type: Residential Burglary via Low-Tech Method

- Asset Class: Private Gold & Diamond Jewelry Collection

- Point of Failure: Compromised Physical Key Security

- Financial Impact (Direct): ~$4,700 USD

- Financial Impact (Implicit Risk): Potentially Catastrophic for Client Trust and Insurability

The Context: The Expanding Perimeter of Retail Responsibility

As the market pivots toward 2025’s emphasis on hyper-personalization, the security perimeter for retailers is no longer confined to vaults and showcases. At-home consultations, private viewings, and wardrobe services are becoming standard practice. This shift places a jeweler’s reputation and liability within the client’s own security infrastructure. A failure in the client’s basic security—like a poorly hidden key—can create a chain of liability and reputational damage, even if the jeweler is not directly at fault. This incident serves as a stark reminder that client education on asset protection is now a fundamental component of luxury service.

The Impact: The Mandate for Proactive Client Security Advisory

For a US-based retailer or investor, this is not a distant headline; it is a case study in risk management. The loss of a client’s collection, regardless of the cause, can irrevocably damage the relationship and generate negative market sentiment. Retailers must now act as security consultants, advising high-net-worth individuals on best practices for storing and securing their assets. This includes recommending professional-grade home safes, discussing inventory documentation for insurance purposes, and explicitly advising against commonplace but high-risk habits. Integrating security advisory into the clienteling process is no longer an add-on, but an essential defense against financial loss and erosion of trust.

Image Referance: https://daijiworld.com/news/newsDisplay?newsID=1300021