Lede: In December 2025, leading Indian actresses and actors chose substantial statement pieces—from Golecha’s uncut Polki to Amrapali’s turquoise sets and Tanishq’s refined necklaces—driving short‑term premium demand and reappraising artisanal pieces as investable luxury. The appearances on magazine covers and at high‑profile events have translated into measurable resale interest and stronger wholesale enquiries for heritage house work.

- Price: On request / undisclosed

- Carat Weight: Undisclosed (uncut Polki cluster)

- Origin: Golecha Jewels — India

- Date: December 2025

Context: 2025 market signals

What these placements reveal is twofold. First, a renewed appetite for materially expressive pieces — uncut Polki with a vitreous luster, dense sapphire‑and‑turquoise ensembles with a tactile presence, and finely set diamond forms that read as sculptural rather than merely decorative. Second, a bifurcation in buyer intent: younger buyers are drawn to vivid, wearable sculpture, while high‑net‑worth collectors prize provenance and artisanal handwork that confer scarcity.

Select highlights

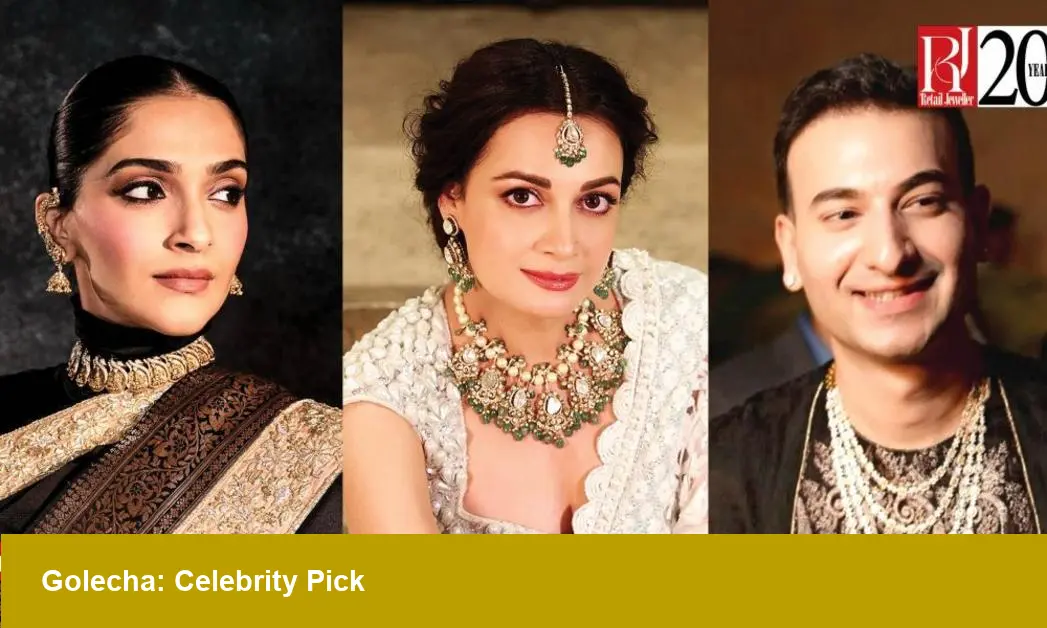

• Dia Mirza wore an uncut Polki necklace by Golecha Jewels, layered with pearls and full‑cut diamonds, the pieces showing substantial heft and a softly reflective surface characteristic of Polki.

• Janhvi Kapoor’s Amrapali set paired turquoise, sapphire and opal in a colourway that emphasizes chromatic contrast and modern glamour.

• Bhumi Pednekar and Shraddha Rama Shrinath opted for precisely set diamond pieces from Tanishq and Akoya Jewels, where vitreous luster and micro‑setting craft create a refined surface texture.

Impact for US retailers and investors

For buyers and stockists in the US market, the trend signals opportunity and risk in equal measure. Opportunity: artisanal Indian maisons are commanding sharper retail premiums and stronger secondary‑market interest, particularly for identifiable makers and signature techniques. Risk: provenance must be documented; undisclosed origins or inconsistent hallmarking can compress margins at resale.

Practical actions for US buyers:

- Curate select heritage pieces with clear maker attribution and condition reports to support resale pricing.

- Price for tactile qualities — substantial heft, well‑defined finish and visible handwork — not only weight and carat.

- Position coloured‑stone statements alongside lab‑grown offerings to capture both the scarcity premium of artisanal work and the accessibility of newer technologies.

Why this matters into 2026

As sustainability narratives and lab‑grown value continue to reshape purchase decisions, handcrafted statement jewellery is carving a parallel premium: buyers are willing to pay for craft provenance and sculptural presence. For US retailers, that means inventory strategy should balance provenance, tactile quality and clear storytelling to convert celebrity visibility into retail performance.

Retail Jeweller India News

Image Referance: https://retailjewellerindia.com/celebrities-favour-statement-jewellery-by-top-brands-in-display-of-contemporary-glamour/