Indie designers are reshaping Resort 2026 jewelry and shifting retail economics: smaller ateliers are trading high-gloss sparkle for tactile materials and heirloom craft, prompting higher sell-throughs and new margin tiers for U.S. stockists.

- Price: Typical retail range $150–$4,500 (corded necklaces to stone-set statement pieces)

- Carat/Weight: Mostly bead and cabochon sizes; gem weights under 1 ct are common; pearls measured by diameter, not carats

- Origin: Independent ateliers across the U.S. and Europe (examples: AGMES, Bea Bongiasca, Blome, Reut)

- Date: Resort 2026 trend, published Dec. 13, 2025

What’s changing

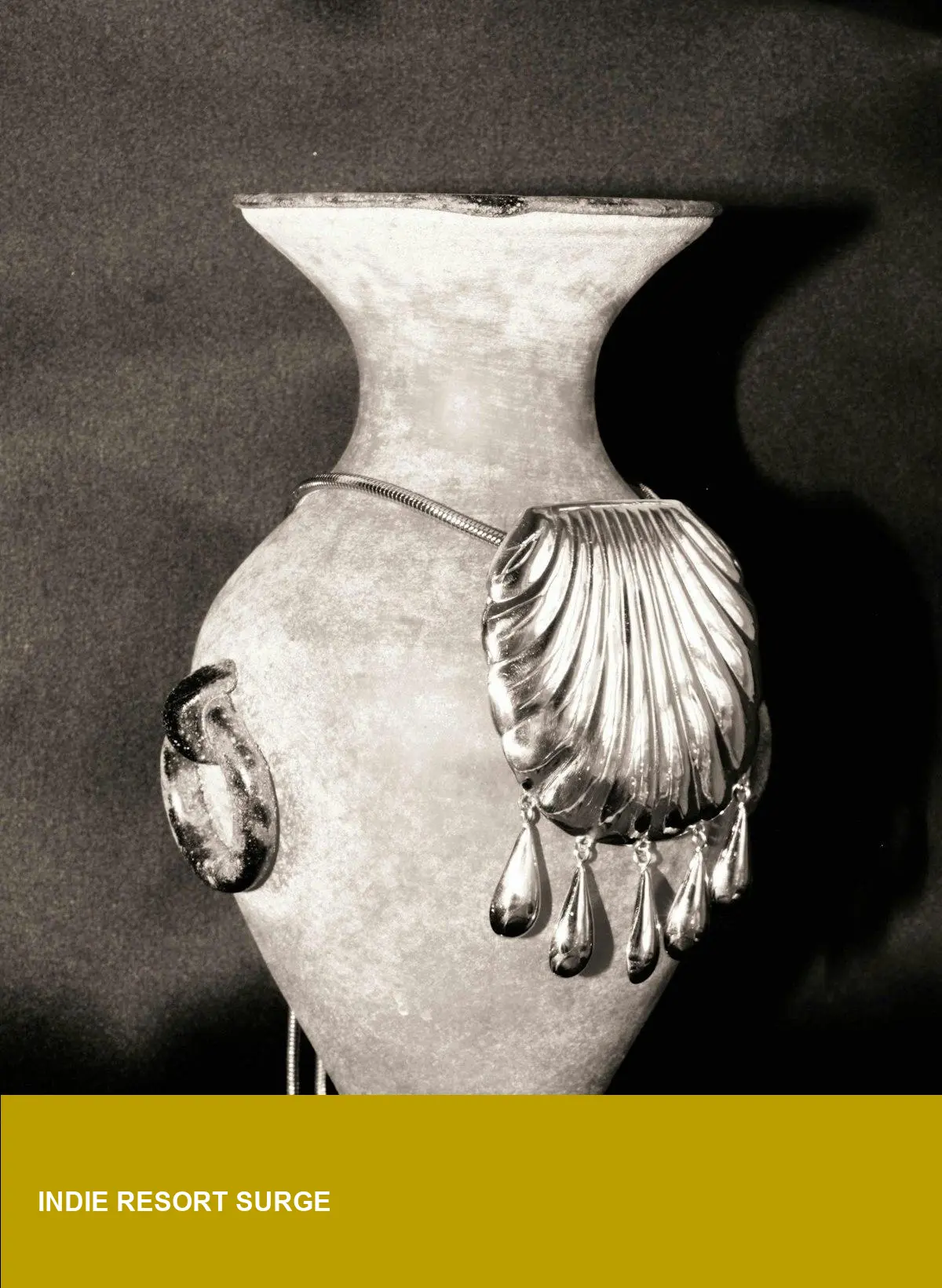

Resort 2026 from independent jewelers is defined by coastal silhouettes and a material-first approach: matte carnelian and warm-hued agates with a subtly granular hand, satiny nacre from baroque pearls, braided cotton cords with a substantial heft, and hand-filed silver that keeps a soft, tactile edge rather than mirror polish. The effect reads less like showy opulence and more like considered possession—an object with vitreous luster or a slow, rubbing warmth against the skin.

How this aligns with 2025–26 market drivers

Three forces converge. First, sustainability: small-batch sourcing, traceable stones and reduced production runs lower carbon intensity and appeal to value-driven buyers. Second, lab-grown diamonds remain a parallel category, but this wave privileges organic and craft-forward materials that carry a different consumer narrative and margin profile. Third, sculptural aesthetics—pieces that read like small objects rather than logos—fit both social-media editoriality and a longer resale horizon.

Why it matters to U.S. retailers and investors

For buyers, these collections create distinct merchandising tiers. Lower-price corded necklaces and beadwork deliver high velocity and entry-point traffic; mid-price sculptural silver and semi-precious stone pieces improve average order value without the inventory risk of large diamonds. For investors, scarcity comes from limited runs and provenance—pieces with clear atelier origin and hand-work command premiums on resale platforms. Inventory strategy should shift from volume of identical SKUs to curated drops that emphasize material story and serial-numbered provenance.

Practical implications

Merchandising: reserve dedicated display space with low-sheen lighting that emphasizes nacre and matte stone surfaces rather than bling. Pricing: expect higher markups on artisan work because consumers pay for perceived craft and traceability. Marketing: prioritize tactile storytelling—close-ups of braided cords, the granular surface of carnelian, the satiny play of pearl nacre—and weave supply-chain notes into product copy. Buying: scout trade-show premieres and limited-edition collaborations; secure exclusivity for seasonal bestsellers to protect margin.

Seen from the floor, Resort 2026’s indie wave is not a fad but a structural shift: buyers are trading pure sparkle for pieces with a palpable hand, and that tactile quality is now a measurable commercial advantage.

Image Referance: https://www.lofficielusa.com/fashion/resort-jewelry-2026-trends-pearl-necklaces-maritime-inspired-jewelry-small-designers