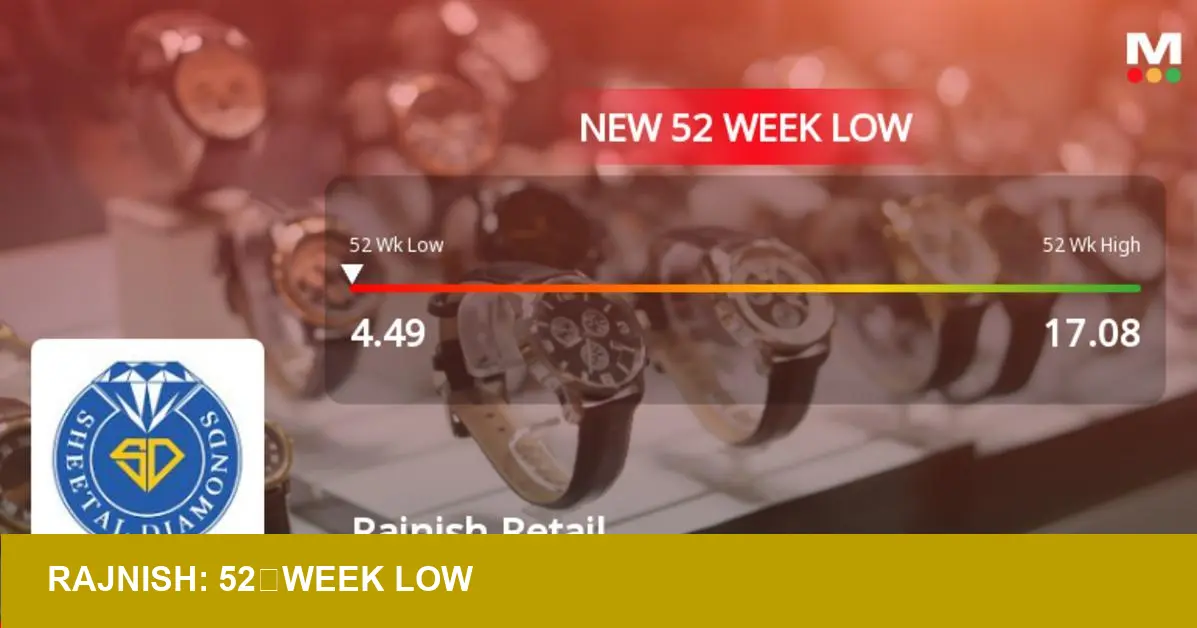

Rajnish Retail Ltd. slid to a 52‑week low of Rs.4.49 on Dec. 17, 2025 — an intraday fall of 9.84% that leaves the stock down roughly 62% year‑on‑year and underlines persistent earnings erosion and technical weakness.

- Price: Rs.4.49 (52‑week low)

- Intraday change: -9.84% | Volume: 9.77 lacs

- 52‑week high: Rs.17.08 | 1‑yr return: -61.98%

- Profit contraction: -74.8% Y/Y | EBITDA: negative

- Exchange: BSE/NSE | Date: Dec 17, 2025

Market Context

The decline extends a recent losing streak and places Rajnish Retail below all principal moving averages — a technical configuration that signals sustained downside momentum. The stock’s capital structure shows negligible debt, yet profitability has deteriorated sharply: profits are down nearly three quarters and EBITDA is negative despite six consecutive quarters of positive net sales, with a quarterly peak at Rs.35.03 crore. Trading is dominated by non‑institutional holders, which amplifies intraday swings and reduces predictable liquidity.

2025 Trends That Frame This Move

Two sector forces are at work for specialty jewellery retailers in 2025. First, a material shift toward lab‑grown stones and traceable supply chains is pressuring legacy inventory, giving some product lines a muted vitreous luster in the eyes of value‑driven customers. Second, market capital is concentrating in larger, well‑capitalised retailers and vertically integrated players; micro‑cap names without clear margin recovery plans are trading on momentum and sentiment rather than earnings stability. Rajnish’s revenue heft offers some ballast, but the balance‑sheet softness and negative EBITDA keep the stock on the wrong side of these trends.

Why This Matters to U.S. Retailers and Investors

For U.S. investors tracking cross‑border retail exposure or sourcing jewellery inventory, Rajnish’s slide is a reminder that sector exposure is bifurcating: firms with scalable e‑commerce, sustainability credentials and healthy margins are commanding premium multiples, while small, regional chains face compressed valuations and higher financing risk. The stock’s micro‑cap profile — low institutional ownership, episodic volume spikes — increases execution risk for any allocation. For retail buyers, vendor stability matters: suppliers with narrow margins and negative EBITDA are more likely to tighten credit terms or compress product refresh cycles, affecting assortment cadence and in‑store availability.

Practical Takeaways and Watchables

- Valuation and risk: Negative EBITDA and a 74.8% profit drop create a structural valuation discount — treat any position sizing as speculative.

- Technical health: Trading below 5/20/50/100/200‑day averages indicates downward momentum; a durable reversal would require sustained moves above the 50‑day line on improving volume.

- Liquidity: Predominantly non‑institutional shareholding can produce sudden gaps; use limit orders and manage exposure size.

- Sector signals: Watch lab‑grown diamond demand, sustainability disclosures, and vendor financing lines — these are leading indicators for recovery in small retailers.

In short, Rajnish Retail’s fall to Rs.4.49 crystallises the twin risks of earnings degradation and micro‑cap illiquidity. The company’s revenue runway offers some substance, but until margins and EBITDA show concrete improvement, the stock will likely remain a high‑risk, event‑driven trade rather than a portfolio cornerstone.

Image Referance: https://www.marketsmojo.com/news/stocks-in-action/rajnish-retail-stock-falls-to-52-week-low-of-rs449-amid-market-pressure-3761313