Short take: Patek Philippe’s Cubitus — a deliberately non-round, recognisable case — shifted in 2025 from a polarising design experiment into a resale phenomenon. Grey‑market bids running at roughly three times retail have reframed how collectors, retailers and investors value sculptural wristwear.

- Price: Retail varies by reference; grey‑market peaks reported at ~3x retail

- Carat weight: N/A (watch case; gem-set variants vary)

- Origin: Swiss (Geneva design/manufacture)

- Date: Case introduced 2023; resale surge through 2025

Ten defining moments, in brief

2025 was less about incremental updates and more about bold gestures: collaborations with designers, shape-led risk-taking, and objects that read as small sculptures rather than mere timekeepers. Below, the year’s most consequential developments and what each signals for value and retail.

Coreen Simpson’s jewellery-and-art presentation

Coreen Simpson’s monograph and exhibitions underline the continuing crossover between fine jewellery aesthetics and contemporary art. Her archival prints — displayed alongside beaded and headpiece work — add provenance-led desirability to jewellery pieces, reinforcing the premium attached to narrative and authorship.

Marty McFly’s calculator watch (Casio revival)

Casio’s reissue of the calculator watch demonstrates how cultural collateral can translate into immediate retail traction. The modest price point and strong nostalgia equity show that not all profitable moments are high ticket: accessible icons can drive footfall and social proof for wider assortments.

Chanel’s haute jewellery reach

Chanel’s high jewellery offering this year married cinema-scale glamour with meticulous gem-setting and vitreous luster finishes. Such top‑tier launches continue to anchor brand prestige and sustain aspirational pricing tiers for retailers carrying luxury maisons.

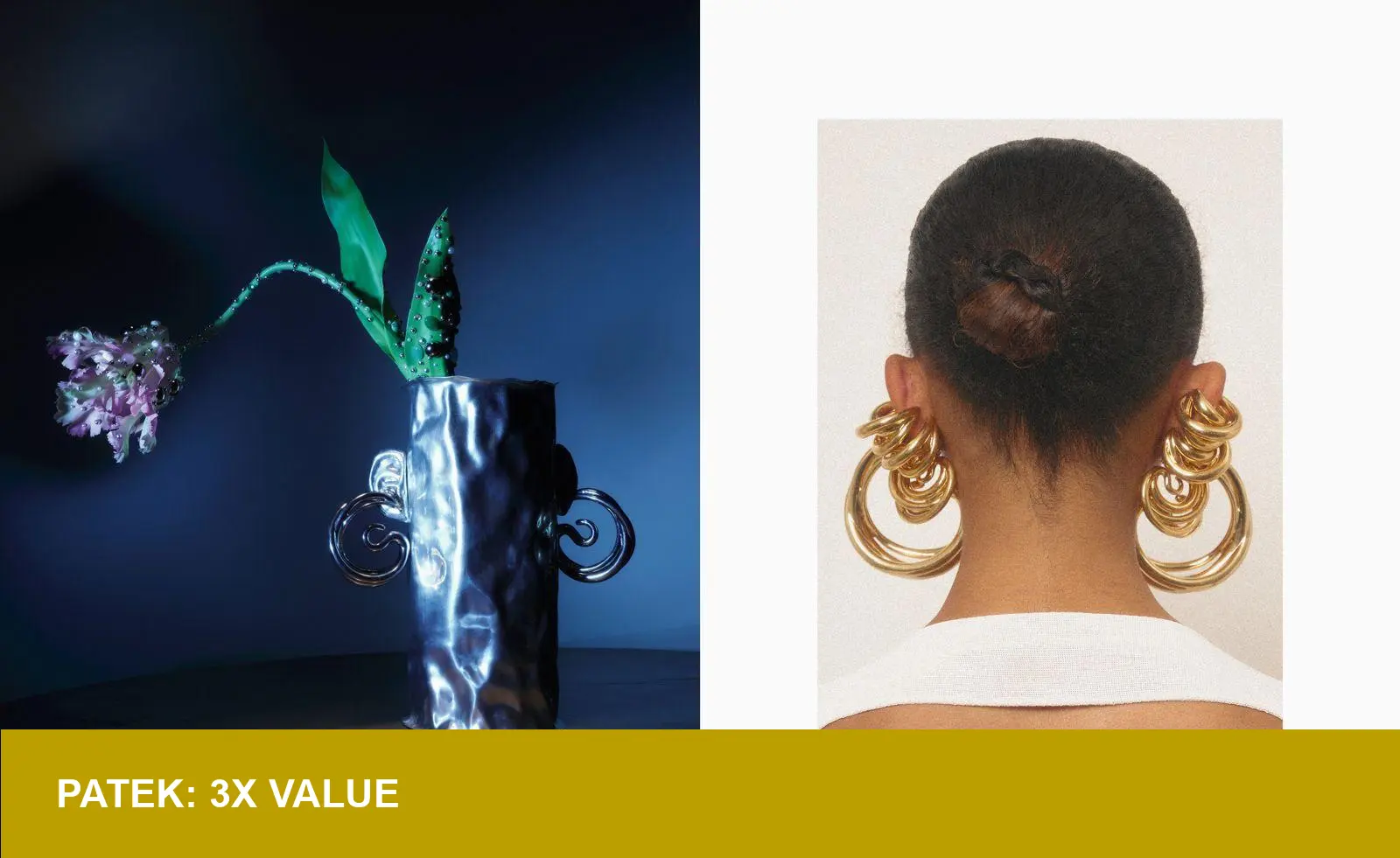

Emma Witter’s jewelled objects

Witter’s sculptures and domestic pieces — pearl‑lined homeware and tactile bone arrangements — point to a blurring of categories. For stockists, these pieces sell as collectible design objects as much as as jewellery, commanding margins for galleries and concept-led retailers.

Yinka Ilori x M.A.D. Editions

Ilori’s chromatic, limited‑run watches for M.A.D. Editions prove collaborations with designers can lift perceived value without traditional haute pricing. Colour, playful scale and clear authorship create collectible scarcity that resellers prize.

Ara Vartanian and Swizz Beatz collaboration

Social‑first introductions — from Instagram messages to Grammys appearances — have accelerated the trajectory from studio piece to red‑carpet staple. Celebrity association continues to act as an immediate multiplier for resale premiums on gem‑heavy pieces.

Watches rejecting roundness

The Cubitus story encapsulates a larger movement: 2025 favoured sculptural silhouettes over the default round case. Deviations from the circular norm read as statement pieces; their recognisability accelerates secondary‑market demand and inflates premiums.

Panconesi’s sensuous design objects

Panconesi translated jewellery proportions into functional home objects — a reminder that tactile finish, polished bevels and substantial heft can justify higher price positioning when design language is coherent across categories.

Gabrielle Greiss’s animal allegories

Greiss’s sculptural animal pieces, with an emphasis on delicate craftsmanship and narrative, attract collectors who value hand‑finished surfaces and provenance, reinforcing the premium for small‑scale, studio‑made jewellery.

Marc Newson x Ressence watch

Newson’s collaboration with Ressence exemplifies industrial design meeting horology: fluid dials, engineered volumes and tactile crowns. Objects that offer a discernible sensory experience — visual depth, substantial heft — command collector attention and retain value.

The Context

Two macro forces shaped these moments in 2025. First, sculptural aesthetics: buyers sought pieces that read as design statements — recognisable silhouettes and architectural cases that photograph well and hold identity in secondary markets. Second, sustainability and provenance: consumers and collectors increasingly price in material traceability and maker narrative. Lab‑grown gemstones continue to gain acceptance for certain categories, but fine jewellery priced for investment still privileges natural stones with certified provenance.

The Impact for US Retailers and Investors

What does this mean for American merchants and buyers? First, assortment strategy should tilt toward recognisable, story‑rich pieces — limited runs, designer collaborations and distinct case shapes perform disproportionately well on resale channels. Second, inventory and pricing models must internalise secondary‑market signals: monitor grey‑market multiples, set recommended‑retail prices with an eye to potential aftermarket uplift, and consider consignment or buy‑back programs for high‑ticket sculptural pieces.

Operationally, invest in provenance documentation and tactile merchandising: encourage in‑store touch, highlight substantial heft, vitreous luster and finishing details in online photography, and provide clear origin narratives. For investors, the lesson is to treat selected watches and jewellery as hybrid assets — part cultural capital, part commodity — where design distinctiveness and demonstrable scarcity drive the upside.

In short: 2025 rewarded conviction — brands and makers that leaned into shape, story and sensory detail found both cultural traction and financial premium. For retailers and investors, the task is to translate those signals into sharper buying, pricing and display strategies.

Image Referance: https://www.wallpaper.com/watches-jewellery/best-watches-jewellery-2025