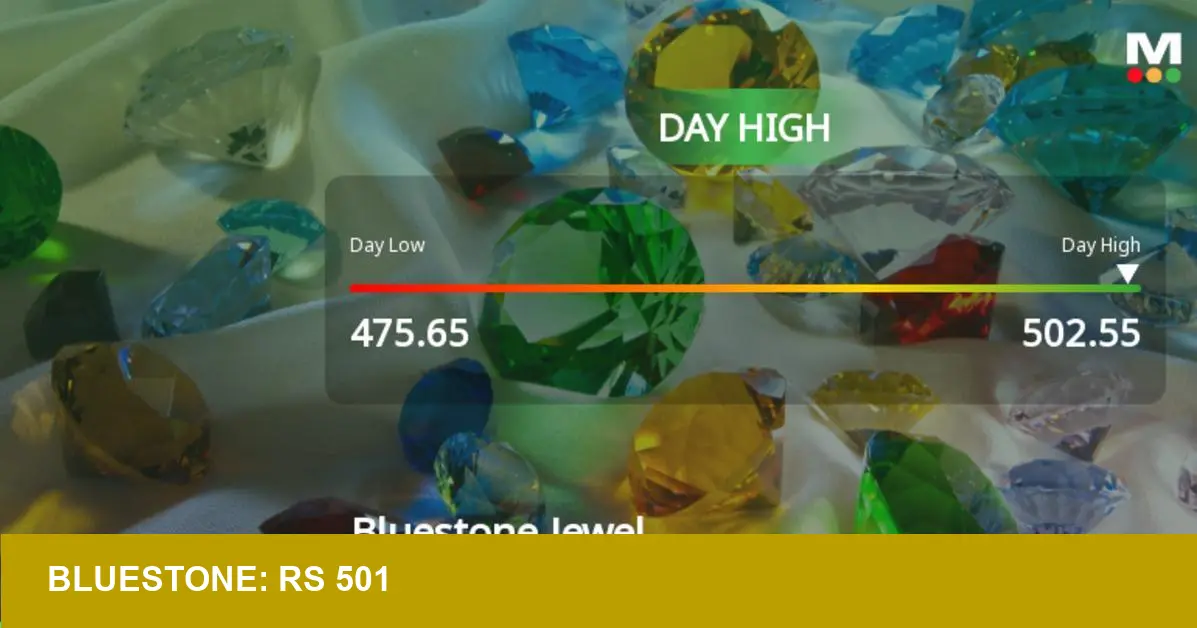

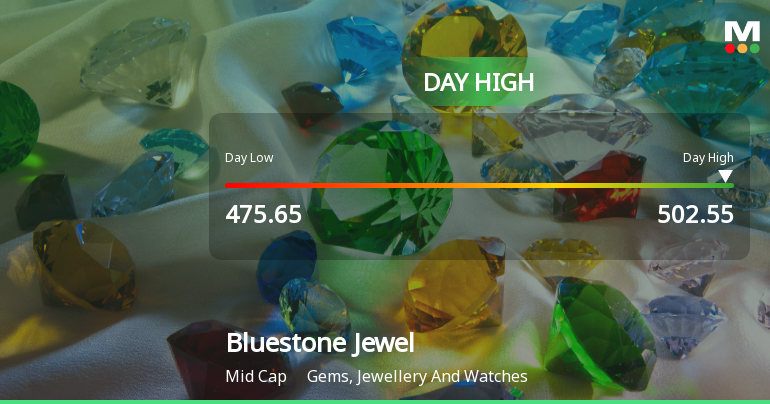

Bluestone Jewellery & Lifestyle Ltd climbed to an intraday high of Rs 501.4 on 2 January 2026, registering a 5.18% gain and sending a clear short-term signal of renewed trading interest — yet company fundamentals and a low Mojo Score counsel restraint.

- Price: Rs 501.4 (intraday high)

- Intraday Gain: 5.18% (session)

- Market Grade: Mid‑cap (Mojo Score 16 — Strong Sell)

- Date: 2 Jan 2026

Where the move came from

The advance outpaced the Sensex and the BSE Mid Cap index on a day when mid‑caps led the market. Trading carried substantial heft — volumes were active and the price held above the 5‑day moving average — but the stock remains below its 20, 50, 100 and 200‑day averages, indicating the rally has not yet cleared established resistance.

Context: jewellery retail in 2025 and beyond

The uptick should be read against three persistent 2025 trends shaping jewellery markets: a premium placed on sustainable sourcing, the rising commercial presence of lab‑grown diamonds, and the continued premium for digitally native, sculptural design houses. Bluestone’s digital‑first model gives it distribution leverage, but that advantage sits alongside structural challenges — negative operating profits in recent periods, a high Debt/EBITDA ratio (~12.3x), and a large slice of pledged promoter stock — which blunt the case for a structural re‑rating.

What this means for US retailers and investors

For US jewellery retailers looking outward, Bluestone’s session is a reminder that demand recovery can appear abruptly yet remain fragile. A 5% intraday pop signals buying interest — potentially for earnings or inventory cues — but does not substitute for margin stability or a clean balance sheet. Buyers should assess suppliers and partners using tactile measures: inventory turn rates, average price per piece (the ‘substantial heft’ of order books) and gross margin quality rather than headline volume alone.

Investor takeaway: tactical, not structural

Short‑term traders may find opportunity in Bluestone’s momentum while it sustains above the 5‑day moving average. Longer‑term investors should weigh the company’s flat multi‑year returns, the Mojo Score of 16 (Strong Sell), and elevated promoter pledges before increasing exposure. Key watch items: next quarterly operating profitability, deleveraging progress, and any reduction in pledged holdings — those are the variables that would convert episodic rallies into durable value.

Bottom line

The Rs 501.4 intraday high is a meaningful market signal — tactile, immediate, and tradeable — but it arrives amid structural headwinds. For US buyers and capital allocators, the sensible posture is measured: recognise the vitreous luster of short‑term demand, but require clearer, sustained improvement in fundamentals before committing capital at scale.

Image Referance: https://www.marketsmojo.com/news/stocks-in-action/bluestone-jewellery-lifestyle-ltd-hits-intraday-high-with-518-surge-3779107