New Delhi — Gold and silver climbed sharply this week, lifting bullion costs and squeezing margins for dealers: 24-carat gold rose by ₹2,340 to close at ₹1,37,122 per 10 grams, while silver advanced ₹8,258 to ₹2,42,808 per kilogram, intensifying price pressure for inventory and finished jewellery.

- Price (Today): Gold ₹1,37,122 per 10 g; Silver ₹2,42,808 per kg

- Purity / Carat: 24-carat (gold)

- Origin: India (New Delhi market close)

- Date: January 10, 2026

Why prices jumped — market drivers

The move has clear structural drivers. A softer US dollar and lower US interest-rate expectations have reduced the opportunity cost of holding non-yielding bullion; central-bank accumulation—particularly sizeable purchases reported from Asia—has drained available supply; and renewed geopolitical friction has pushed safe-haven allocations higher. For silver, the effect is amplified by industrial demand: photovoltaic and electronics fabrication continue to absorb a growing share of available metal, translating to a palpable tightening in the physical market.

2025 in perspective: structural shifts that matter

Last year set the backdrop. On December 31, 2024, 10 g of 24-carat gold traded near ₹76,162; by December 31, 2025 it had approached ₹1,33,195 — a rise with a visibly granular profile rather than a spike, suggesting steady accumulation. Silver’s trajectory was steeper: ₹86,017 per kg at end-2024 to roughly ₹2,30,420 by end-2025, reflecting both demand from industry and manufacturers’ stockpiling ahead of tariff risks.

These moves link directly to three 2025 trends retailers and investors should treat as persistent:

- Sustainability and recycled supply — more buyers and brands request responsibly sourced, recycled gold; recycled streams can blunt or accentuate price moves.

- Industrialisation of precious metals — silver’s role in solar and EV supply chains gives it dual demand drivers: investment and fabrication.

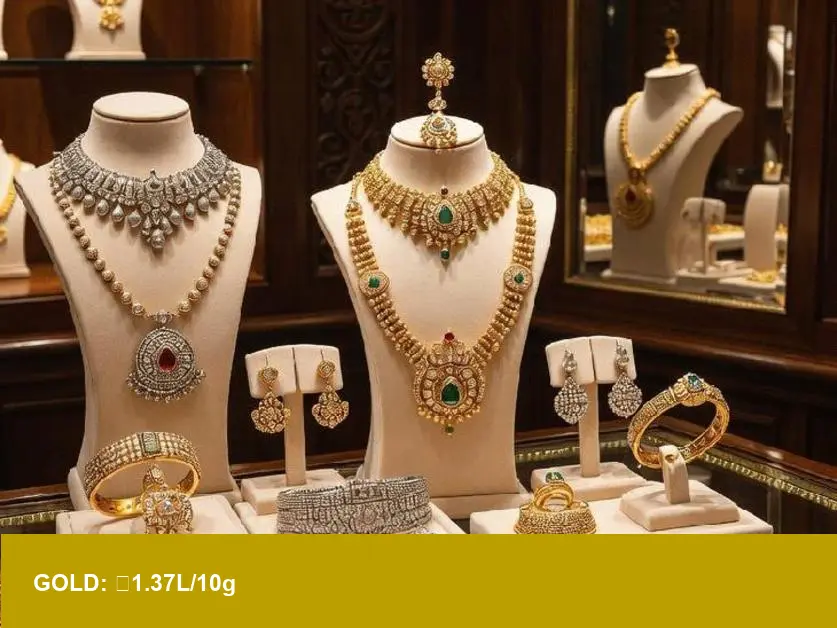

- Sculptural aesthetics and weight-led jewellery — designers are favouring pieces with substantial heft and a vitreous luster, increasing average metal content per piece and raising inventory cost per SKU.

Why this matters to US retailers and investors

For US retailers the immediate effect is margin compression and capital tied up in inventory that now carries greater substantial heft on the balance sheet. Imported inventory or forward-buy agreements will be costlier; price-sensitive customers may delay purchases, widening the retail spread. For investors, bullion remains a hedge against currency and geopolitical risk, but the accelerated silver move — driven by industrial demand — changes allocation calculus: silver behaves increasingly like a hybrid asset with real-economy exposure.

Outlook and actionable guidance

Market advisers are sanguine but cautious. Ajay Kedia of Kedia Advisory projects silver could test ₹2.75 lakh per kg and gold may exceed ₹1.50 lakh per 10 grams within the year if current flows persist. That scenario would further tighten supplies for manufacturers and raise replacement costs for retailers.

- Hedge and ladder purchases: stagger buys or use forward contracts to manage replacement risk.

- Price positioning: consider a modest retail premium on heavier, sculptural pieces to preserve margin while communicating metal provenance and recycled content.

- Supplier diligence: verify hallmarks and BIS certification at invoice (e.g., AZ4524-style markings) and cross-check rates with India Bullion and Jewellers Association before quoting customers.

- Inventory mix: increase SKU focus on lower-weight, higher-margin items to reduce capital tied to metal.

Bottom line

Gold’s vitreous luster and silver’s industrial pull are reshaping cost structures across the supply chain. For US retailers and investors the question is tactical: adjust procurement and pricing to the new baseline rather than waiting for a reversion that may not arrive soon.

Image Referance: https://www.bhaskarenglish.in/business/news/gold-and-silver-prices-surge-this-week-136908968.html