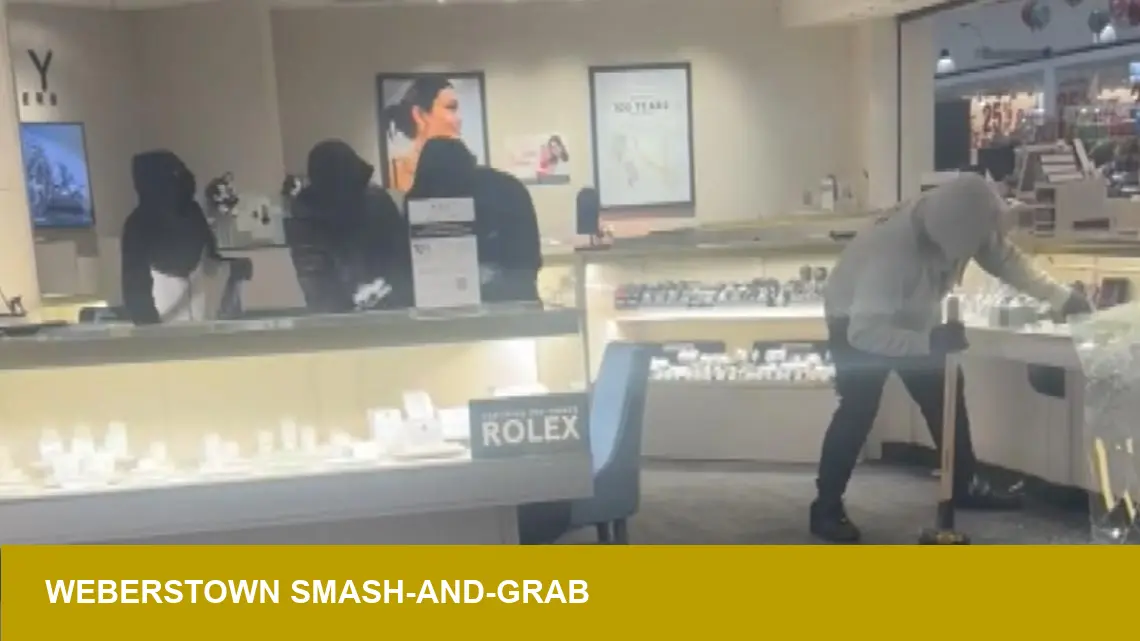

STOCKTON, Calif. — Video shows four assailants armed with sledgehammers clearing display cases in roughly one minute at a Weberstown Mall jewelry store — an incident that tightens the conversation around in‑store loss, insurance exposure and display standards for U.S. retailers.

- Price: Unknown; under investigation

- Carat Weight: N/A (inventory mix not disclosed)

- Origin: Weberstown Mall, Stockton, California

- Date: January 11, 2026

Credit: ABC10 — Author: Gabriel Porras — Published: January 11, 2026

The scene

Surveillance reviewed by police shows four people arriving just after 5 p.m., wielding sledgehammers and moving with coordinated haste. Witnesses described shards of tempered glass scattering across the floor and the rapid removal of merchandise; law enforcement radio traffic indicates officers arrived less than a minute after the emergency call, narrowly missing the suspects. The store remained closed over the weekend while investigators sifted through video and cellphone footage.

Context — What this means in 2025

Since 2025 the specialty jewelry sector has been adjusting to two parallel pressures: tighter consumer demand for traceable, lab‑verified stones and escalating costs for on‑site security and insurance. Incidents like this compress both issues. For retailers carrying a mixed inventory of mined and lab‑grown stones, the event forces immediate questions about valuation differentials and resale routes — and whether certain inventory is more likely to be targeted. The optics here are tactile: the vitreous luster of loose stones and the substantial heft of bracelet stacks are now liabilities to be accounted for in store planning and asset reporting.

Impact for retailers and investors

For U.S. retailers the near‑minute smash‑and‑grab is not merely a headline; it is an operational inflection point. Expect three direct consequences:

- Insurance and underwriting: underwriters will review loss severity and response times — claims from quick, destructive raids tend to push premiums and require narrower policy language on inventory types and display protections.

- Fixture and layout investment: retailers will accelerate spend on laminated or polycarbonate vitrines, anchored displays and modular stock control that reduce exposure and allow for rapid reconciliation.

- Inventory strategy and liquidity: buyers and store managers may shift higher‑turn, lower‑on‑site‑value assortments to limit shrinkage and favor secure centralized storage with rapid transfer capabilities to retail floors.

For investors, the immediate metric to watch is same‑store shrinkage and the marginal cost of security per square foot. Small, rapid raids like this compound into materially higher operating expenses over a portfolio, which can erode thin jewelry margins and change valuation multiples for brick‑and‑mortar heavy chains.

Operational notes

Mall management and private security teams typically act as observers and relays to law enforcement; this incident underscores that model’s limits for preventing swift, destructive thefts. Retailers should evaluate silent alarms, timed drop safes and staff protocols that prioritize rapid lockdown over direct intervention. Visible measures — patrol vehicles, hardened display cases and sensor arrays — also recalibrate shopper perception; in this case, mall patrons reported feeling safe despite the violence, but sustained confidence depends on demonstrable, physical mitigation.

Police continue to investigate. Retailers and insurers will be watching the outcome closely as they reassess risk, display design and inventory policy across U.S. shopping centers.

Image Referance: https://www.abc10.com/article/news/local/stockton/smash-and-grab-robbery-weberstown-jewelry-store/103-b33c445d-14e8-44a2-86f2-1c9fee2421b8