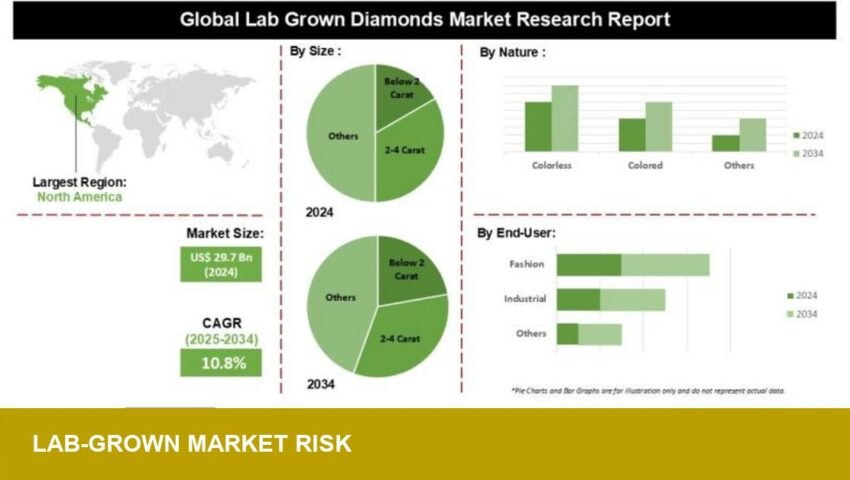

Insightace Analytic Pvt Ltd has published a press release on openPR.com titled “Lab‑grown Diamonds Market Penetration and Growth Forecast 2026 to 2035.” The report addresses expected market penetration and growth for lab‑grown diamonds through 2035 and flags strategic implications for supply, pricing and retail margins as the segment expands.

- Publisher: Insightace Analytic Pvt Ltd (press release on openPR.com)

- Report title: Lab‑grown Diamonds Market Penetration and Growth Forecast 2026 to 2035

- Forecast period: 2026–2035

- Focus: market penetration and growth trajectory for lab‑grown diamonds

- Primary audience: industry stakeholders — manufacturers, retailers, investors

Context: where this sits within 2025–26 industry trends

The release arrives amid a multi‑year shift in the jewellery sector toward greater acceptance of lab‑grown product. Over the last two market windows the conversation has moved from novelty to category planning: brands and retailers are increasingly treating lab‑grown diamonds as a distinct merchandise tier rather than an occasional promotional SKU. The report’s title confirms industry attention is now focused on penetration and long‑range growth, not short‑term experimentation.

For wholesale and retail buyers this trend intersects with other 2025–26 dynamics — inventory rationalisation, margin discipline and consumer segmentation. Where differentiated finish, setting quality and certification standards are absent, lab‑grown product is most likely to compete on price and availability, which changes buying patterns for bridal and accessible‑luxury assortments.

Impact: why US retailers, wholesalers and investors should take note

Even without headline figures in the press release itself, the report’s focus on penetration and growth through 2035 signals a strategic inflection that requires adjustment at multiple levels:

- Merchandising: Buyers should re‑examine assortment architecture — allocating distinct SKUs and merchandising language for lab‑grown pieces to protect margins on natural diamonds and to meet different consumer expectations.

- Pricing strategy: Growing penetration typically compresses price differentials between tiers. Retailers will need clear price ladders and margin modelling to avoid margin erosion on higher‑ticket natural‑diamond items.

- Inventory and sourcing: Wholesalers may rationalise SKUs and increase flexibility in sourcing to respond to faster inventory turnover for lab‑grown lines versus geological stones.

- Investor signals: The focus on long‑term penetration makes lab‑grown diamonds a category to track for capital allocation decisions in manufacturing, retail platforms and certification/traceability services.

For US market players the practical takeaway is operational: establish clear product and certification standards for lab‑grown offerings, segment assortment and messaging, and update margin models. The Insightace press release underscores that lab‑grown diamonds are no longer peripheral; the question for traders and investors is how to translate that penetration into sustainable pricing and inventory strategies without undermining natural‑diamond premium positioning.

Image Referance: https://www.openpr.com/news/4364112/lab-grown-diamonds-market-penetration-and-growth-forecast-2026