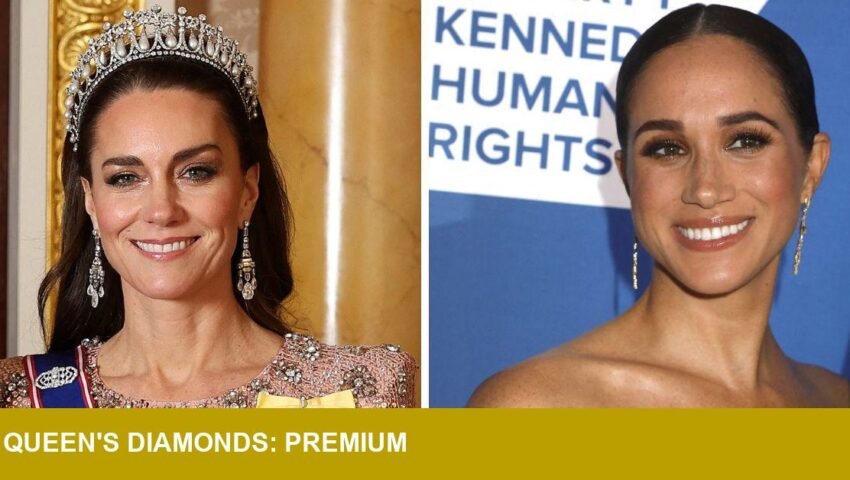

Princess Catherine’s decision to wear Queen Elizabeth II’s diamond chandelier earrings at a December state banquet is being read as more than ceremonial: it is a demonstrable market signal that institutional provenance can command a measurable premium in the high-end jewelry market.

- Price: Not publicly disclosed — institutional/provenance premium expected

- Carat weight: Not confirmed publicly — multi‑stone pear drop with baguette and round accents

- Origin: Queen Elizabeth II’s collection, United Kingdom (deaccessioned for public wearing)

- Date: Worn publicly Dec. 3, 2025; reported Jan. 17, 2026

Why the moment matters

The pieces — described as three slim strands of round and baguette diamonds supporting a pear‑shaped drop with fringed diamond strands — possess a vitreous luster and visual heft that read as institutional rather than intimate. In jewellery markets, that distinction translates into two things: a narrative premium for provenance and a functional premium for perceived authenticity. When a high‑profile figure repeatedly deploys historic jewels at state events, those objects cease to be merely personal heirlooms and begin to trade on their role as symbols of continuity.

Context: 2025 trends and what this signals to the trade

Across 2025 the luxury jewellery market has bifurcated along three axes: provenance-led demand, the growing market for responsibly sourced and lab‑grown alternatives, and a taste for sculptural, statement silhouettes. The Queen’s diamonds sit squarely in the first category — their value derives from institutional lineage and public visibility rather than from cut‑for‑market optimization or ethical narrative alone. For US buyers, that means historic royal provenance can outmaneuver lab‑grown pricing when the story and visibility are strong.

Impact for US retailers and investors

For retailers and private collectors in the United States, the implications are practical and immediate. Provenance is becoming a market lever: certified association with a notable collection can lift demand and margins, particularly in auction and private‑sale channels. Retailers should consider three responses:

- Curate storytelling: invest in authenticated provenance narratives and catalogue histories — buyers pay for verifiable lineage.

- Position inventory: offer inspection reports that emphasize institutional associations and condition, and prepare for higher insurance and consignment valuations.

- Leverage partnerships: pursue museum loans, exhibition tie‑ins and editorial opportunities that mirror the visibility royal usage creates.

That said, there are risks. Institutional provenance can attract politicised scrutiny or ownership disputes; it also places weightier demands on conservation and security budgets. Pricing should therefore internalize carrying costs and potential legal complexity.

Takeaway

Princess Catherine’s repeated use of Queen Elizabeth’s chandelier earrings does more than settle a public rivalry narrative — it reframes how high‑value historic jewels function in the modern market. For US jewellery professionals, the lesson is clear: provenance and public visibility can generate a distinct premium. The trade should prepare to price, promote and protect that premium accordingly.

Image Referance: https://radaronline.com/p/princess-kate-middleton-meghan-markle-bling-war-inherited-jewelry/