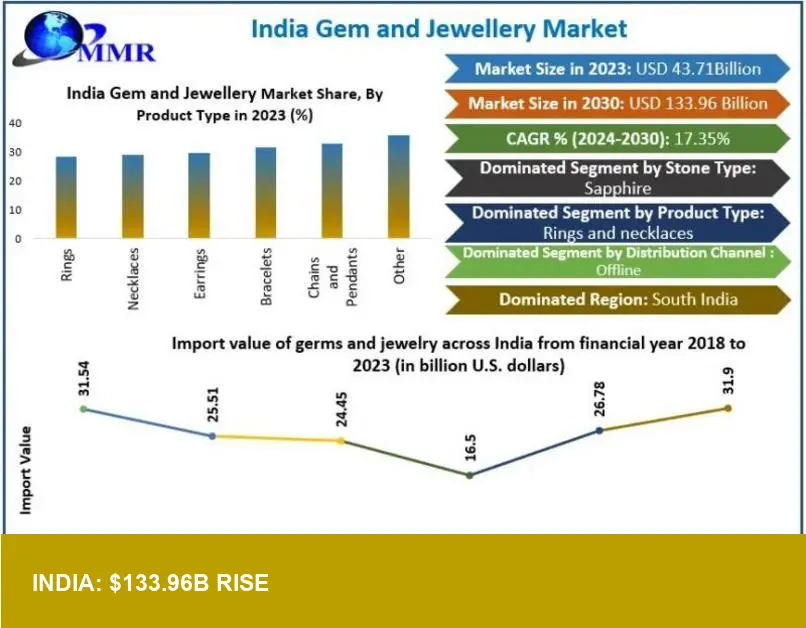

Maximize Market Research projects that India’s gem and jewellery market will expand at a 17.35% CAGR to approximately USD 133.96 billion by 2030, rising from a 2024 base and reshaping retail inventories, export flows and investor allocations.

- Price: USD 133.96 Billion (2030 projection)

- Carat Weight: 17.35% CAGR (2025–2030)

- Origin: India

- Date: Report (2024)

Market snapshot

The report from Maximize Market Research places India at the center of a rapid expansion in gemstone and jewellery demand. The market’s vitreous luster is not only cultural — driven by weddings and festivals — but increasingly commercial, with branded and hallmarked product lines gaining substantial heft in urban retail channels and online platforms.

Context: how 2025 trends feed the surge

Three 2025-era currents explain the projection. First, sustainability and ethical sourcing are moving from marketing copy to supply‑chain practice: traceability, recycled gold and verified origins command pricing premiums. Second, lab-grown diamonds are redefining value tiers — offering a lower-cost, consistent aesthetic with a smooth, crystalline face that appeals to younger buyers and increases turnover. Third, sculptural and wearable design — pieces with palpable heft, refined filigree and pared-back finishes — are shifting inventory mix toward higher-margin statement and daily-wear categories.

Drivers and constraints

Key drivers include rising disposable income, stronger branded retail penetration, and export momentum driven by India’s legacy in cutting and polishing. At the same time, volatility in gold and diamond quotations, regulatory complexity around hallmarking and taxation, and competition from unorganized sellers will test margins and inventory strategies.

Why this matters to US retailers and investors

For US multi‑brand retailers and specialty jewelers, the report signals three practical moves: secure differentiated supply (ethical sourcing and certified inventory), reprice assortments to reflect segmented demand (lab-grown versus natural), and accelerate omnichannel fulfilment to capture cross-border consumers. For investors, the projection highlights export leverage — Indian manufacturing scale plus design-led product can compress sourcing costs while preserving margin, provided counterparties manage metal-price exposure and regulatory risk.

Actionable takeaways

- Prioritise certified inventory and supply‑chain transparency to command premiums and support resale value.

- Segment assortments: offer lab‑grown lines for rapid turnover and natural gemstones for higher-margin, provenance-led sales.

- Hedge metal exposure where possible and design flexible pricing tied to real‑time gold indices.

- Invest in digital merchandising: refined product imagery that conveys vitreous luster and substantial heft converts better online.

Maximize Market Research’s projection is a market mandate: Indian production and domestic demand are converging with global trends in sustainability and design. For US market participants, that convergence is both an opportunity to source competitively and a prompt to rethink inventory, certification and pricing frameworks.

Image Referance: https://www.openpr.com/news/4347272/india-gem-and-jewellery-market-to-grow-at-17-35-cagr-reaching