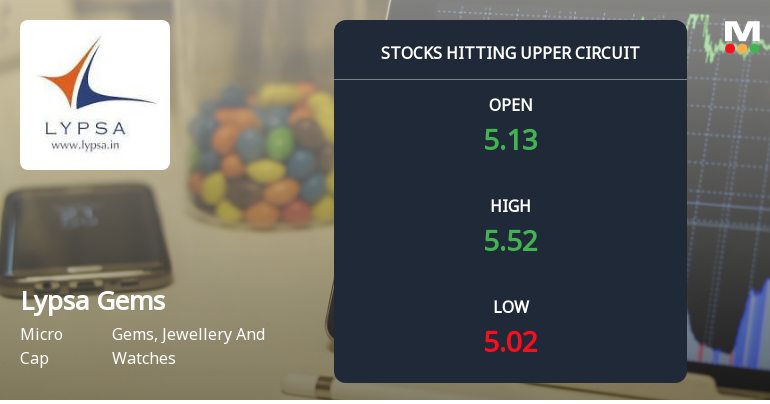

Lypsa Gems & Jewellery Ltd (stock ID: 596697) surged to its upper circuit on 31 Dec 2025, closing at ₹5.48 after touching ₹5.50 — a near‑10% intraday move that concentrated buying pressure into a thin market and instant regulatory freeze.

- Price (close): ₹5.48

- Intraday high: ₹5.50 (10% band)

- Market cap: ≈ ₹15 crore

- Date: 31 Dec 2025 — Volume: 1.02592 lakh shares

What happened

The tape registered a compact but forceful advance: the stock gained ₹0.48 (9.6%) from the prior close, with buy orders outstripping available supply and many bids left unfilled when the exchange imposed an automatic freeze. Turnover was modest — roughly ₹0.0545 crore — yet sufficient to push the price to the statutory limit, underscoring how micro‑cap names can move decisively on concentrated order flow. Delivery on 30 Dec stood at 68,230 shares, a 2.93% decline versus the five‑day average, suggesting a mix of short‑term speculative interest and aggressive intraday buying.

Context within 2025 jewellery market trends

The move comes against a backdrop of measured strength in the Gems, Jewellery & Watches sector (up 2.01% on the day) supported by steady gold prices and seasonal retail demand. In 2025, two structural themes have recalibrated sector dynamics: the premium placed on traceable, sustainable sourcing and the growing commercialisation of lab‑grown diamonds. For micro‑cap jewellers like Lypsa, these currents can translate into quick spikes in investor attention when the market anticipates an operational or product‑led catalyst — the tape feels the change before fundamentals have fully repositioned.

Technical and rating read

Technically the stock trades above its 5‑, 20‑ and 50‑day moving averages, signalling short‑to‑medium term strength, yet it remains below the 100‑ and 200‑day averages — a reminder that the rally has not yet cleared the longer horizon. MarketsMOJO’s proprietary assessment assigns a Mojo Score of 17.0 (Strong Sell), a rating that reflects weak fundamentals and elevated risk despite the intraday exuberance.

Why US retailers and investors should care

For US buyers of jewellery stocks or firms scouting sourcing partners, the episode is a study in liquidity risk and price discovery. A micro‑cap market cap — what one might call a paper‑thin float — can produce sudden price condensation: small volumes translate to substantial percentage moves, and regulatory freezes can leave orders unfilled, creating pent‑up pressure that distorts subsequent sessions. Tactical traders may find short‑term opportunities in such moves; longer‑term investors must reconcile the market action with weak fundamentals, thin execution depth and sector exposure to sustainability and lab‑grown competition.

Practical takeaways

- Upper circuit reflects concentrated demand, not necessarily a durable turnaround.

- Volume and delivery trends should be monitored for confirmation before adding exposure.

- Small market cap increases execution risk for larger orders — scale positions accordingly.

- Factor sector trends (sustainable sourcing, lab‑grown diamonds) into any fundamental reassessment.

In short: the upper‑circuit event offers a clear short‑term signal of renewed appetite, but the stock’s Strong Sell rating and micro‑cap profile counsel caution. Traders can exploit the volatility; investors must wait for clearer confirmation of fundamental improvement before treating the move as more than a concentrated market impulse.

Image Referance: https://www.marketsmojo.com/news/stocks-in-action/lypsa-gems-jewellery-ltd-surges-to-upper-circuit-on-strong-buying-momentum-3776235