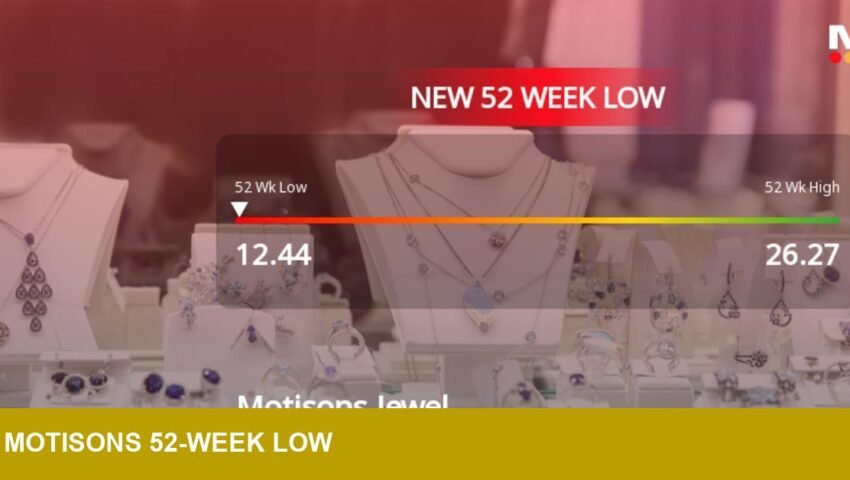

Motisons Jewellers Ltd has reached a new 52‑week low of Rs.12.64, registering a notable decline amid broader market fluctuations and company‑specific performance challenges. The move underscores renewed investor scrutiny of small‑cap jewellery retailers and raises questions about near‑term margin resilience.

- Price: Rs.12.64 (52‑week low)

- Company: Motisons Jewellers Ltd

- Currency: INR (Indian rupee)

- Context: Decline amid broader market fluctuations and company‑specific performance

Context: where this sits in current jewellery market dynamics

Equity moves in jewellery retailers often track discretionary spending, inventory cycles and input‑cost pressure. A 52‑week low at Motisons signals tighter investor tolerance for execution risks — from inventory turnover to gross margin compression — especially within smaller, less diversified operators. For the jewellery category, that can translate into slower reorder rates for finished goods and a re‑pricing of receivables and working‑capital assumptions by lenders.

Operationally, retailers facing demand softness typically prioritise SKU rationalisation and liquidity: higher‑turn, lower‑ticket items; tighter purchase terms with suppliers; and closer control of finished‑goods ageing on the retail floor and in warehouses. Those adjustments feed back into supplier orderbooks and can compress vendor margins further down the chain.

Impact: why US buyers, wholesalers and investors should take note

For US stakeholders — importers, wholesalers and cross‑border investors — a small‑cap jewellery stock hitting a 52‑week low is a signal to reassess exposure rather than a call to immediate divestiture. Practical implications include:

- Credit and supplier risk: US buyers sourcing from the region should refresh counterparty checks and payment terms to mitigate supply interruptions.

- Inventory strategy: wholesalers and retailers may prefer higher turnover, lower ticket SKUs and clearer provenance to preserve margins if supplier stress widens.

- Portfolio positioning: investors should weigh company‑level execution risk against sector fundamentals; a price at a 52‑week low can reflect market‑wide volatility as much as idiosyncratic weakness.

Motisons’ price action is a timely reminder that jewellery retail equities remain sensitive to consumer sentiment and working‑capital cycles. For trade professionals, the appropriate response is disciplined risk management: tighten payment terms, monitor inventory ageing and maintain clarity in product and margin reporting rather than rely on short‑term valuation moves.

Image Referance: https://www.marketsmojo.com/news/stocks-in-action/motisons-jewellers-ltd-stock-hits-52-week-low-amidst-continued-downtrend-3794495