Silver prices breached a historic ceiling, topping $59 per troy ounce for the first time, while gold secured a new record-high weekend fix. This surge, however, is not a simple indicator of economic confidence; it is a direct consequence of significant fragmentation in the industrial metals market, particularly copper, signaling a complex and volatile period ahead for investors.

- Silver All-Time High: Surpassed $59 per troy ounce.

- Gold Record Weekend Fix: $4,235 per troy ounce.

- Key Driver: Geopolitical trade friction and strategic stockpiling.

- Market Warning: Impending commodity index rebalancing in January 2026.

The Anatomy of a Fractured Market

The current volatility in precious and base metals is driven less by organic demand and more by structural pressures. Commodity traders are aggressively withdrawing inventory from London Metal Exchange warehouses, a strategic move largely in response to US tariff uncertainties. This has created a bifurcated market: while the United States shores up its copper supply, the rest of the world is experiencing increasing tightness. This is not a supply crunch in the traditional sense, but a market fracturing along geopolitical lines, creating arbitrage opportunities and significant price distortion.

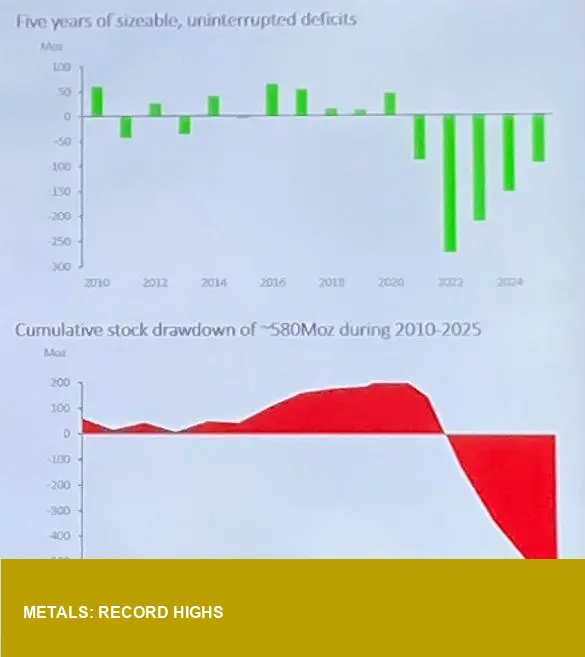

Silver’s Structural Deficit Meets New Tech Demand

According to specialist analysis from Metals Focus, silver is on track for another market deficit in 2026. While its use in photovoltaics is becoming more efficient, leading to lower consumption per unit, this decline is being offset by a voracious new demand from the AI and data center industries. This shift in industrial consumption, coupled with constrained mining output—where over 70% of silver is a byproduct of other metal extraction—maintains a persistent underlying tightness in physical supply.

Investor Outlook: A Looming Rebalance

The record-setting price gains in 2025 have created a critical situation for commodity-basket indices. Both the S&P GSCI and Bloomberg’s BCOM will undergo a mandatory rebalancing in January 2026. Gold, for instance, has grown to 19.4% of the BCOM by value, far exceeding the 15% maximum for any single commodity. According to Swiss bullion group MKS Pamp, this will trigger “mega net selling” as funds are forced to sell their overweight positions in gold and silver to meet new targets. US investors should therefore view the current highs with caution, as a significant technical correction is now programmed into the market for the new year.

Image Referance: https://www.bullionvault.com/gold-news/gold-price-news/silver-copper-deficit-markets-120520251