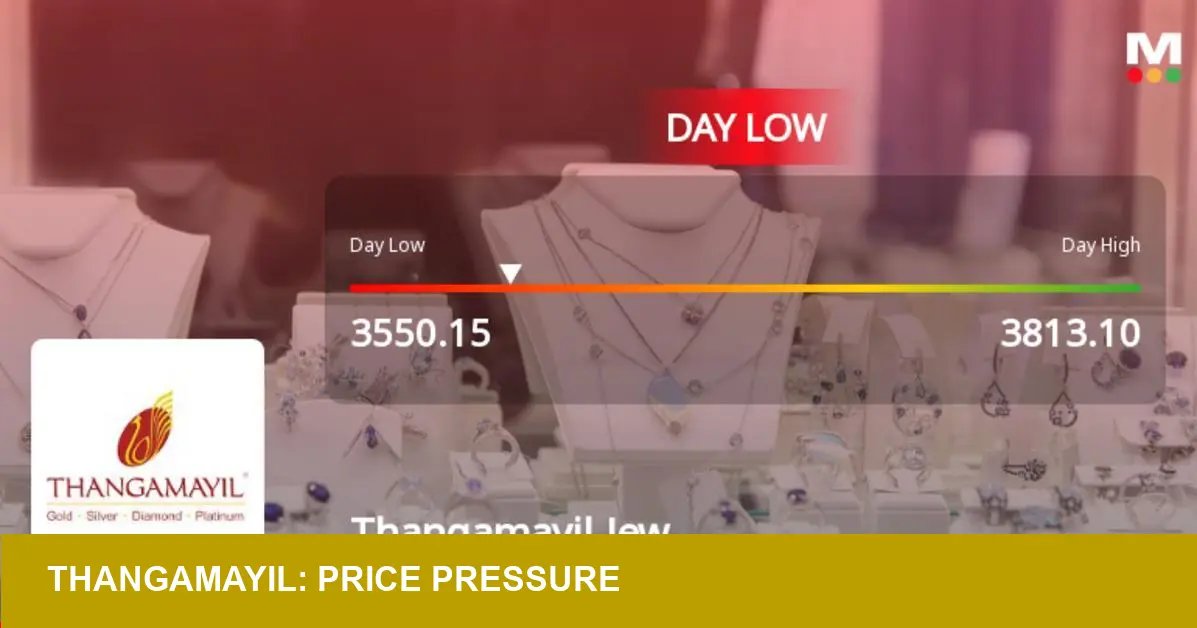

Thangamayil Jewellery Ltd slipped to an intraday low of ₹3,550.15 on Jan 9, 2026 — a 7.33% daily loss that trimmed gains from a four-session rally and exposed near-term vulnerability.

- Price (close / intraday low): ₹3,603.55 / ₹3,550.15

- Change: -7.33% (intraday down -8.7%)

- Volume: 4.7 lakh shares

- Exchange / Date: BSE & NSE — 9 Jan 2026

Market context

The drop came on a negative-open day for the broader market — Sensex closed down 0.72% — but Thangamayil’s decline materially outpaced both the index and its sector. After a 13% gain over the prior week and a three-month advance north of 77%, the stock’s price behaviour on Jan 9 reads like a classic profit-taking episode rather than a structural break. Yet the decline also served as a reminder that even high-momentum jewellery names carry convex risk when sentiment shifts.

Why this matters in 2026

Two 2025–26 retail vectors frame the move. First, sustainability and traceability have been lifting margins for brands that demonstrate supply-chain clarity; second, consumer demand has rotated toward sculptural, design-forward pieces that command higher ticket prices and carry a different margin profile than commodity gold. For a regional jewellery player such as Thangamayil, these forces create both upward levers and episodic volatility: rising discretionary designs can lend vitreous luster to same-store sales, while gold-price swings and profit-booking impose short-term pressure.

Immediate market read

Technically, the stock opened with a 2.52% gap down and tested support at ₹3,550.15 before settling with a 7.33% loss at close. Notably, it remains above the 5-, 20-, 50-, 100- and 200-day moving averages — a sign that the medium-term trend retains substantial heft even as short-term momentum cooled. The downgrade in the firm’s Mojo Grade from Strong Buy to Buy in November 2025 may have nudged risk-aware holders to harvest gains; the Mojo Score of 78.0 nonetheless signals continued institutional confidence in fundamentals.

Implications for US retailers and investors

For US buyers and portfolio managers watching the global jewellery supply chain, this episode is instructive rather than alarmist. A pronounced intraday correction in a well-performing Indian jewellery stock underscores three practical points:

- Inventory strategy: maintain a balance between substantial-heft gold inventory and higher-margin designer pieces to smooth margin volatility.

- Position sizing: treat recent outsized returns as an opportunity to trim rather than add, unless conviction is supported by refreshed fundamental catalysts.

- Cross-market signal: stronger relative performance versus the Sensex over 1–5 years highlights growth potential in select regional players, but also higher beta to local market swings.

Takeaway

Jan 9’s price action is a consolidation in a longer uptrend: a correction that tests support and investor resolve rather than a decisive reversal. For traders it is a reminder to respect stop levels; for longer-term investors it presents a moment to review exposure and the company’s conversion of design-led demand into durable margin expansion.

Image Referance: https://www.marketsmojo.com/news/stocks-in-action/thangamayil-jewellery-ltd-hits-intraday-low-amid-price-pressure-3787354