Gustavo Oro Jewelry owner reports a rapid smash‑and‑grab that cleared roughly $1.1–1.2 million of inventory in under 10 seconds, raising immediate questions about store security, insurance exposure and inventory strategy for U.S. retailers.

- Price: $1.1–$1.2M (owner estimate)

- Carat Weight: Mixed inventory; total carat weight not disclosed

- Origin: Gustavo Oro Jewelry Shop, Jersey City, NJ

- Date: Thursday evening, ~6:48 p.m.

The Incident

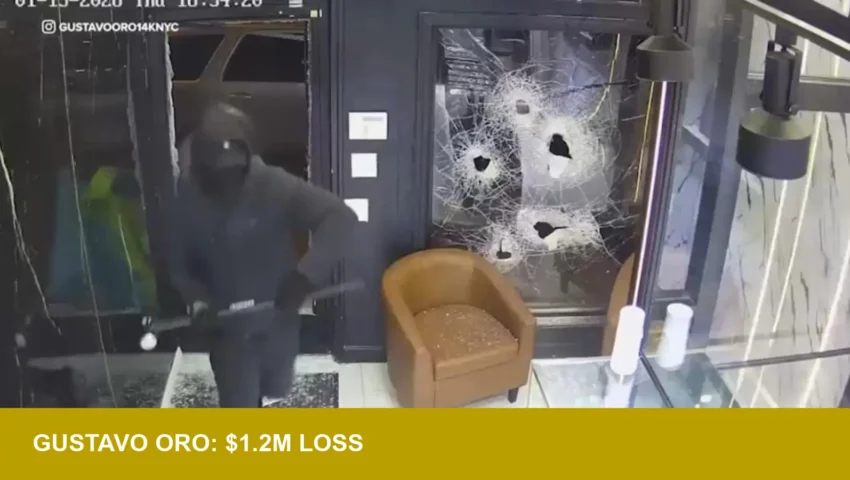

New surveillance video shows four people forcing entry by shattering the storefront glass, then entering and using mallets to pulverize the vitreous display cases. The raid lasted only seconds — the owner said employees fled safely through a back door while the robbers filled a laundry bag and departed with what he describes as “everything.” Sanchez estimates the loss at roughly $1.1–$1.2 million. He added recent security glass over counters was no match for the tools used.

Context: What This Means in 2025

The episode arrives as U.S. jewelers recalibrate for a year defined by two converging pressures: rising operational risk and a shifting product mix. Retailers increasing exposure to lab‑grown stones and smaller, higher‑margin design pieces must now weigh inventory liquidity against physical vulnerability. Insurance carriers are already adjusting underwriting on in‑store inventories, and loss scenarios like this will accelerate investment in hardened vitrines, remote verified monitoring and rapid response protocols.

For designers and buyers, the tactile economics matter: pieces with substantial heft or notable provenance attract disproportionate loss risk. Even as sustainability-led sourcing and lab‑grown diamonds change how inventory is purchased and marketed, those items still present concentrated financial exposure on the shop floor.

Impact for U.S. Retailers and Investors

Practical consequences are immediate. Independent retailers should expect higher premiums and stricter policy conditions; institutional buyers will reassess store‑level stock strategies; and multi‑location operators may centralize marquee inventory or increase armored transit frequency. Staff safety protocols and emergency egress training become a balance of hospitality and protection.

For investors, the incident underscores a latent operational risk that can erode margins: a single event can wipe a quarter or more of annual gross merchandise value for small operators. Mitigants that matter now include real‑time inventory reconciliation, insured carriage for high‑value items, and design choices that prioritise display resilience without eroding the perceived vitreous luster that sells.

Owner Gustavo Sanchez described the emotional toll plainly: “I just sat crying… thinking of how things like this can happen.” The business calculus that follows will be sober: reassess physical defences, revisit coverage, and reengineer how value is held and presented in a market where theft tactics are fast, coordinated and increasingly bold.

Image Referance: https://abc7ny.com/post/jersey-city-smash-grab-robbers-take-off-full-inventory-jewelry-store/18416905/